Circular 13 & 41 System Report

-

1. Objective

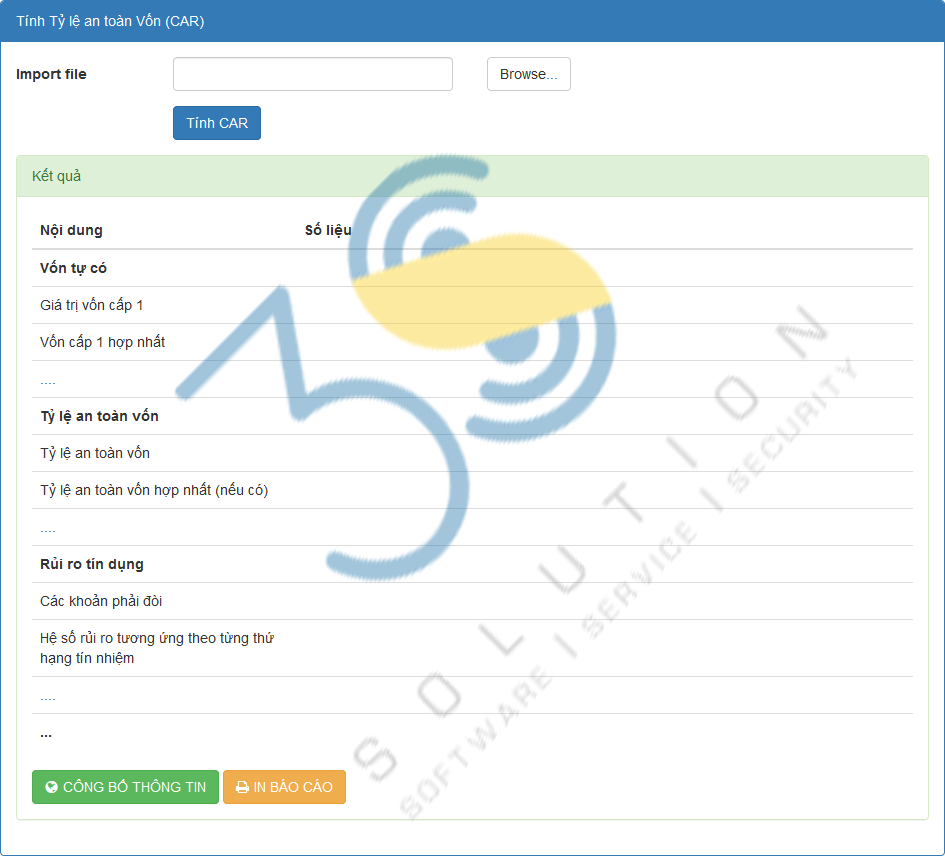

- Develop application for calculating capital adequacy ratio (CAR) and risk management according to Circular 41/2016 / TT-NHNN, and prepare information for the Circular 13/2018 / TT-NHNN meeting the Basel II application roadmap.

- Meet the circulars of the SBV. -

2. Highlights

-

1. The system is designed to meet Basel II of the State Bank.

- Build Database system in the direction of Datamart to focus on specific operations, easily upgrade each part.

- Develop an algorithm to calculate the capital adequacy ratio and optimal risk ratio. In which the system prepares for calculating credit risk components in many different ways such as standardized approach, platform IRB (F-IRB), high-end IRB (A-IRB) when the State Bank Specific instructions.

-

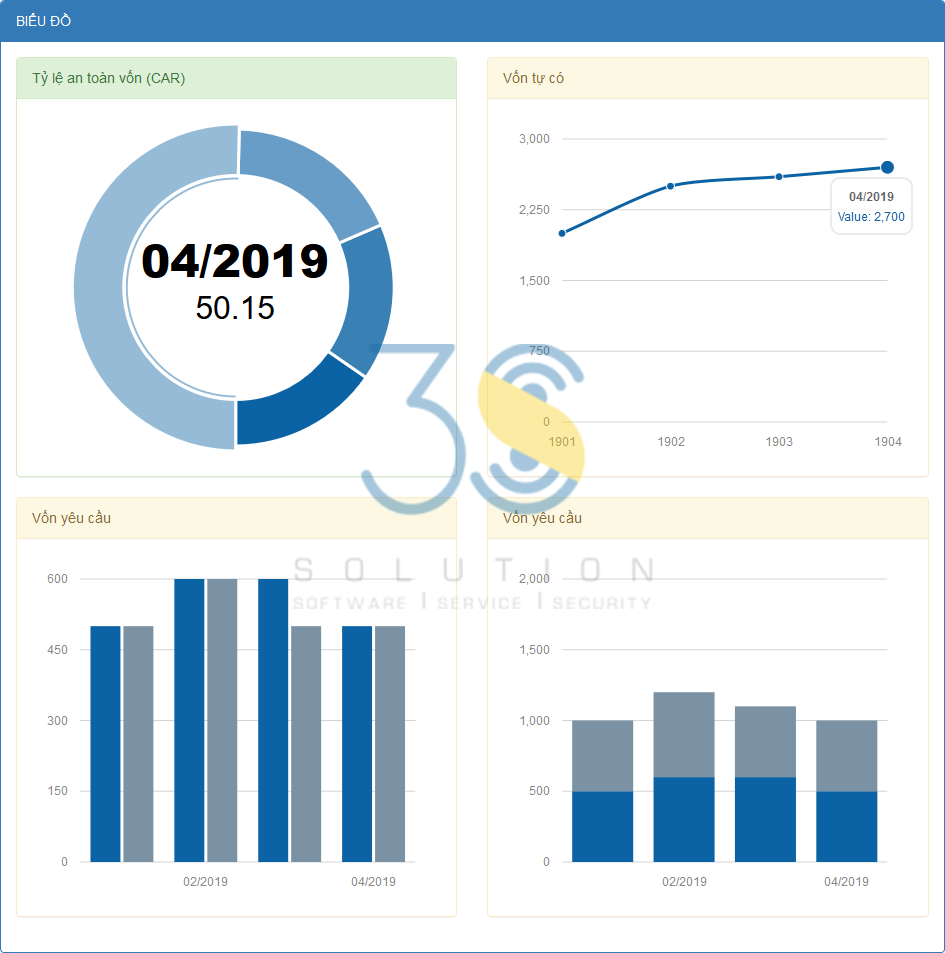

2. The system has the ability to support BI (Business Intelligence)

- From the calculation results, the system provides diagrams and prepares solutions to assess risk reduction, and build suitable business strategies, as well as internal policy procedures to control credit risk, market risk, internal audit

-

3. The system can be supported as Data management

- Data system management method; storage management; to be able to check the accuracy of data; save source of data logs, cross-check users to ensure correct input data, result in minimized miscalculation system.

-

4. The system is designed in the direction of modularization

- So embedding new modules or upgrading each module is simple and fast. And easily upgrade integrated new rules or reports.

-

5. Web application platform

- That users can access anytime, anywhere via internet or internal connection.

-

7. The system is analyzed, designed and developed in accordance with the requirements of the State Bank of Vietnam

- With friendly interface, appropriate features, easy to use.

-

8. Applying the process of "Evolutionary Prototype Process" to develop the project to reduce the time of customers when making software requirements.

-

9. Support multi-language interface:

- By default Vietnamese and English; It can be extended to other languages as required by the bank.

-

10. 3SS CORP has:

- A skilled workforce in analyzing requirements, user interface design, development and deployment, system architecture and project management ready to serve the project & actualize the system. 3SS CORP brings you the best service for developing and deploying the system.

-

11. 3SS CORP provides 12 months free warranty:

- After the project is handed over and accepted. During the warranty period, 3SS CORP will support patching and software upgrade for free when a new version is released.

-

12. Audit & Pentest software"

- 3SS Corp software is advised by security experts before building core architecture, during software development and before 3SS when the system release at banks.

-

13. Automation Test Applying:

- Helping banks to easily check and accept before submitting reports to the State Bank.

-

-

3. System Model

-

System Datasource:

Mission to gather data from Core Banking, BI (Business Intelligence), Data Warehouse, or from files (excel, csv, txt ...) or other data sources to calculate capital adequacy ratio (CAR) and risk management. -

Reporting system:

In charge of calculating capital adequacy ratio (CAR) and risk management from System Datasource to meet Circular 41/2016 / TT-NHNN.

-

-

4. Screen of System